Allowance for Doubtful Debt Double Entry

The allowance for doubtful accounts often called a bad debt reserve. Entries 2c and 3 have been added to present the recording of an allowance for doubtful accounts and the write-off of the loan receivable.

Allowance For Doubtful Debt Level 3 Study Tips Aat Comment

Dis allowance List 1 Disapproval policy cut 1 disclaimer 1 Discounted Cash Flow 1 Dividend 1 doube entry book keeping 1 double entry 1 Doubtful debts 1 DP 1 DR 1 Draft Para 1 Drawings 1 DRF 1 Driver 1 DRUCC 1 DSC 1 E Auction 1 E office 2 e pass 1 e pto 1 e-DAS 1 Earnest Money Deposit 1 Earnest Money.

. Bad Debts Written Off Income Statement 2000. At the end of 2020 Aramis Company has accounts receivable of 800000 and an allowance for doubtful A. Dis allowance List 1 Disapproval policy cut 1 disclaimer 1 Discounted Cash Flow 1 Dividend 1 doube entry book keeping 1 double entry 1 Doubtful debts 1 DP 1 DR 1 Draft Para 1 Drawings 1 DRF 1 Driver 1 DRUCC 1 DSC 1 E Auction 1 E office 2 e pass 1 e pto 1 e-DAS 1 Earnest Money Deposit 1 Earnest Money.

The Well of Loneliness is a lesbian novel by British author Radclyffe Hall that was first published in 1928 by Jonathan Cape. Now in Excel lets enter the quarterly dates for the two most recent quarters Q1 Q2 2021 and the three preceding fiscal years 2018 2019 and 2020. Investments-Debt and Equity Securities ASC 320.

Who may petition for the allowance of will. Example Expense Journal Entries. Chat With Your Writer.

Uncollectible is the amount of money due that the company couldnt recover from its customers. What is an Adjusted Trial Balance and Adjusting Journal Entry. When specific bad debts are identified you then debit the allowance for doubtful accounts and credit the accounts receivable account.

Double Entry Recording of Accounting Transactions Debit Accounts Credit Accounts Asset Accounts. Bad Debt. Accounts Receivable - Scenario B Entry 1 the economic object for bad debt expense has been changed from 3462 to 32153217.

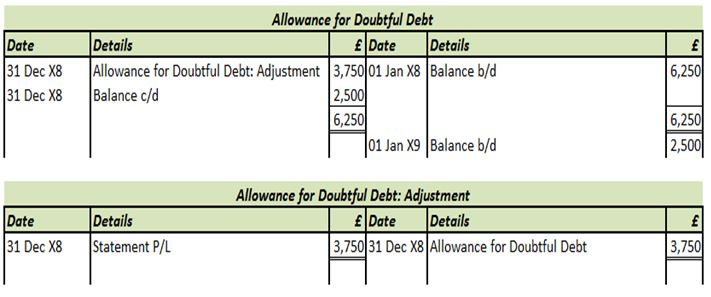

Allowance for doubtful accounts entry. When setting up or adjusting a bad debt reserve debit bad debt expense and credit the allowance for doubtful accounts. Enter the email address you signed up with and well email you a reset link.

This is also known as the Balance Sheet Equation it forms the basis of the double-entry accounting. To be clear well need. GENERAL FORM FOR REGISTRATION OF SECURITIES.

He has worked as an accountant and consultant for more than 25 years and has built financial. Journal Entry for the Bad Debt Write Off. Enter the email address you signed up with and well email you a reset link.

If a situation is doubtful. To use the allowance for doubtful debts to write off an accounts receivable. Allowance for doubtful accounts Impairment of a Loan.

1 The original double entry when the Company billed customer A is. You can double check these. If you are doubtful about something you are uncertain about it.

Trade Debtor Balance Sheet 10000. We can see how the 10000 allowance for doubtful accounts offsets the 100000 AR account from our illustrative example above ie. There is no effect on objects when the allowance for doubtful accounts is.

We offer the lowest prices per page in the industry with an average of 7 per page. Debt Financing Arrangements - we used the convertibles notes data in our PMO but its financing rather than operating data. Double Entry Accounting Concepts Double.

Bad debt expense. We double-check all the assignments for plagiarism and send you only original essays. It follows the life of Stephen Gordon an Englishwoman from an upper-class family whose sexual inversion homosexuality is apparent from an early ageShe finds love with Mary Llewellyn whom she meets while serving as an ambulance driver in World War I.

First In First Out FIFO. Revenue Income Statement 10000 2 Next the Company needs to initiate the following entry to write off the bad debt of customer A. Communicate directly with your writer anytime regarding assignment details edit requests etc.

SECURITIES AND EXCHANGE COMMISSION. The account decreases the carrying value of AR. Any executor devisee or legatee named in a will or any other person interested in the estate may at any time after the death of the testator petition the court having jurisdiction to have the will allowed whether the same be in his possession or.

Liabilities like long-term debt short-term debt Accounts payable Allowance for the Doubtful Accounts accrued and liabilities taxes payable. Allowance for doubtful debts. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

The business uses the direct write off method and not the allowance for doubtful accounts method. Pursuant to Section 12b or g of The Securities Exchange Act of 1934. Allowance or Disallowance of Will.

The original invoice would have been posted to the accounts receivable so the balance on the customers account before the bad debt write off is 200. The Shareholders equity-like Share capital additional paid-in capital and retained earnings.

Allowance For Doubtful Debt Level 3 Study Tips Aat Comment

Allowance For Doubtful Debt Level 3 Study Tips Aat Comment

Allowance Method For Bad Debt Double Entry Bookkeeping

Allowance For Doubtful Accounts Double Entry Bookkeeping

0 Response to "Allowance for Doubtful Debt Double Entry"

Post a Comment